RIIZE confirmed a Tokyo Dome run just 2 years and 5 months after their debut.

The group’s leap into Tokyo Dome shows both speed and influence.

It reflects SM Entertainment’s systematic planning and a highly mobilized fanbase.

At the same time, it stands as a sign of 5th‑generation K‑pop’s global expansion potential.

Breaking Records with Speed — RIIZE at Tokyo Dome

Overview

This is a rapid achievement.

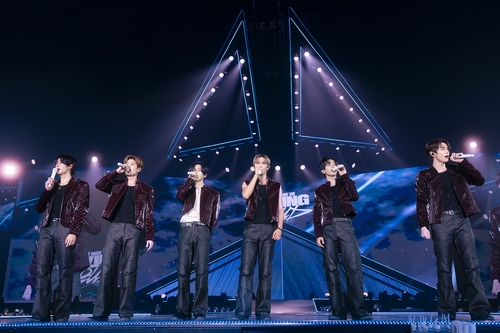

RIIZE, a 5th‑generation K‑pop boy group that debuted in September 2023, announced a solo concert run at Tokyo Dome from February 21–23, 2026.

That timing makes them one of the fastest K‑pop boy groups to book Tokyo Dome.

The announcement spread quickly through SM Entertainment’s official channels and local Japanese media response.

Key fact: debut to Tokyo Dome in 2 years 5 months, three shows confirmed

Meaning: confirms the speed of 5th‑generation K‑pop and the power of organized fandom

History and Symbolism

The record is symbolic.

Tokyo Dome is one of Japan’s largest stages (a major stadium used for concerts and sports), and playing it is often seen as proof of an overseas act’s commercial reach.

Previous acts such as BTS and TVXQ used Tokyo Dome dates to cement their position in Japan.

RIIZE’s unusually fast entry therefore signals not just a record being broken but a possible generational shift and structural change in the industry.

What Tokyo shows test: they verify both recognition abroad and ticket‑selling power.

Arguments in Favor

This is a positive signal.

First, it reinforces K‑pop’s global standing by showing that a very new group can command large venues overseas.

Second, from an economic perspective, successful big shows feed back into the cultural export value of Korean content and can generate wider financial ripple effects for the industry.

Third, it demonstrates that some new groups can reach major markets quickly.

Summary: even newcomers can grow quickly. That sends a hopeful signal across the industry.

More concretely, RIIZE’s case can spark fresh investment and new business opportunities.

Revenue streams tied to concerts, merchandise, and local promotion bring cash not only to the label but to touring staff and local partners.

SM Entertainment’s planning and distribution channels allow upfront spending and an attempt at rapid returns.

This approach depends on a concentrated fanbase—fans who buy tickets, stream music, buy goods, and amplify the group online—thereby increasing market value.

Beyond cultural impact, there is an industrial lesson.

RIIZE’s path offers a blueprint for other rookies: standardized processes in planning, training, marketing, and live operations can raise the whole industry’s professionalism.

Therefore, the event may encourage long‑term stability and specialization in the business side of pop music.

Concerns and Criticisms

The pressure is real.

Rapid success has shadows.

First, there are health risks for members. Health here means both physical and mental health (physical fitness and emotional well‑being).

Combining a high‑profile stadium run with long tours early in a career can lead to exhaustion and stress.

Summary: speed equals achievement, but without proper care it becomes a burden.

Second, market overheating and intensified competition are concerns.

RIIZE’s rapid rise may set an unrealistic benchmark for newer or smaller labels lacking capital and connections.

That dynamic can reinforce a system favoring established big companies, risking less diversity and diminished creative space.

Third, questions about content quality and sustainability arise.

If strategy focuses too narrowly on short‑term events, artistic development and long‑term capabilities may be sacrificed.

That outcome could prompt fandom attrition and long‑term brand erosion. Meanwhile, activity in Japan brings its own social and diplomatic sensitivities, adding further uncertainty.

Lastly, there are financial risks.

Scaling up stadium productions quickly requires major upfront spending. If revenue projections fall short, losses can be hard to recover.

Such outcomes affect internal cash management at the label and investor confidence. Therefore, financial governance and clear return‑on‑investment plans matter as much as growth speed.

In‑depth Analysis

Multiple factors combined to make this happen.

First, SM Entertainment’s strategic planning and global network were decisive. SM has long experience in market research and local partnerships, and they structure revenue models with early investment and risk sharing.

Second, the global spread of 5th‑generation K‑pop set a favorable backdrop. Social platforms and digital distribution have transformed how fandoms form, accelerating awareness in markets like Japan.

Third, dense fan activity—ticket buying, streaming, and social engagement—helped guarantee strong early demand.

Core drivers: strategic planning + concentrated fandom + global momentum of 5th‑generation K‑pop

Online reaction has been mostly celebratory.

Many posts express pride and excitement. However, a noticeable minority raises alarms about member welfare and the durability of such fast growth.

That mix of voices shapes public discourse and pressures management to respond with concrete measures like health monitoring and schedule adjustments. Ultimately, success should be judged not just by stadium dates but by a sustainable plan that protects artists and secures long‑term careers.

Contrasting Views

Two poles coexist.

Supporters emphasize national branding and market expansion. They argue RIIZE’s Tokyo Dome shows deserve celebration as a success in cultural export and an encouraging sign for the industry.

Critics stress the risks of speed: potential harm to artists and an industry skewed toward a few powerful players.

Pro: highlights opportunities and economic impact

Con: warns about over‑acceleration and the need for artist protection

From the optimistic angle, RIIZE adds a new route to success: a strong fanbase plus digital platforms can let newcomers win big fast, attracting capital and creating new business models.

From the skeptical angle, that same route risks reinforcing inequalities and prioritizing commercial milestones over artistic growth and wellbeing. The right balance requires industry norms and better internal safeguards.

Practical Recommendations

Careful management and planning are essential.

Labels and management teams should prioritize members’ health and mental wellbeing.

Practical steps include adjusted schedules, regular health checks, and access to professional counseling.

At the same time, firms must outline financial risk management and realistic plans to recover investments.

Advice: build health systems + establish financial risk‑sharing strategies

Continuous local market learning and stronger local partnerships are also important.

Adapting content and communication to regional preferences can deepen long‑term loyalty.

Finally, transparent communication with fans builds trust and can transform short‑term hype into a durable brand.

Conclusion

This is a new milestone.

RIIZE’s Tokyo Dome run showcases the influence and industrial potential of 5th‑generation K‑pop.

However, the burdens that come with speed and questions about long‑term sustainability must be addressed in parallel.

Key takeaway: rapid success is both an opportunity and a responsibility. Protecting artists and managing finances are essential to preserve long‑term value.

In short, RIIZE’s Tokyo Dome dates are worth celebrating.

But the industry should use this moment to redesign the balance between rapid growth and safety nets.

How will you view this achievement? What rules and systems should be put in place going forward?